Simpler Trading – VWAP Max Tool Package – Raghee Horner

- Last Updated: 05-11-2022

- Duration: 3.98 hour(s), 6 video(s)

- Size: 2.5 GB

$49

Buy More, Save More!

2 Courses

10% OFF

3 Courses

15% OFF

5 Courses

30% OFF

Why Choose TSCourses?

- Learn online or download via Google Drive

- All course files are included

- Free course updates via email

- Seen it cheaper? We'll beat the price

Course Description

If you’ve been around trading for any length of time, you’ve probably realized one thing: indicators are everywhere, but true, repeatable edge is rare. That’s exactly the gap Raghee Horner’s “Simpler Trading – VWAP Max Tool Package” is designed to fill – and why this course can quietly become the backbone of a serious, rules-based day and swing trading plan.

And if you want access without paying premium “guru” prices, TSCourses positions itself as the best place to get it: lowest market price, instant Google Drive access, 15-day satisfaction guarantee, and no annoying logins or account bans to worry about.

But before we talk about the deal, let’s look at whether VWAP Max is actually worth your time and capital.

Who is Raghee Horner – and why should you listen to her?

There are plenty of instructors teaching VWAP who’ve only traded a bull market. Raghee Horner is not one of them.

She’s a professional trader with over three decades of live market experience, now Managing Director of Futures Trading at Simpler Trading, one of the most recognized trading education brands in the U.S. She started charting her mutual funds as a teenager on graph paper and never left the markets. Over the years she built a system-based, process-driven style that focuses on trend, structure, and risk management rather than impulsive “signal chasing.”

Raghee is known for:

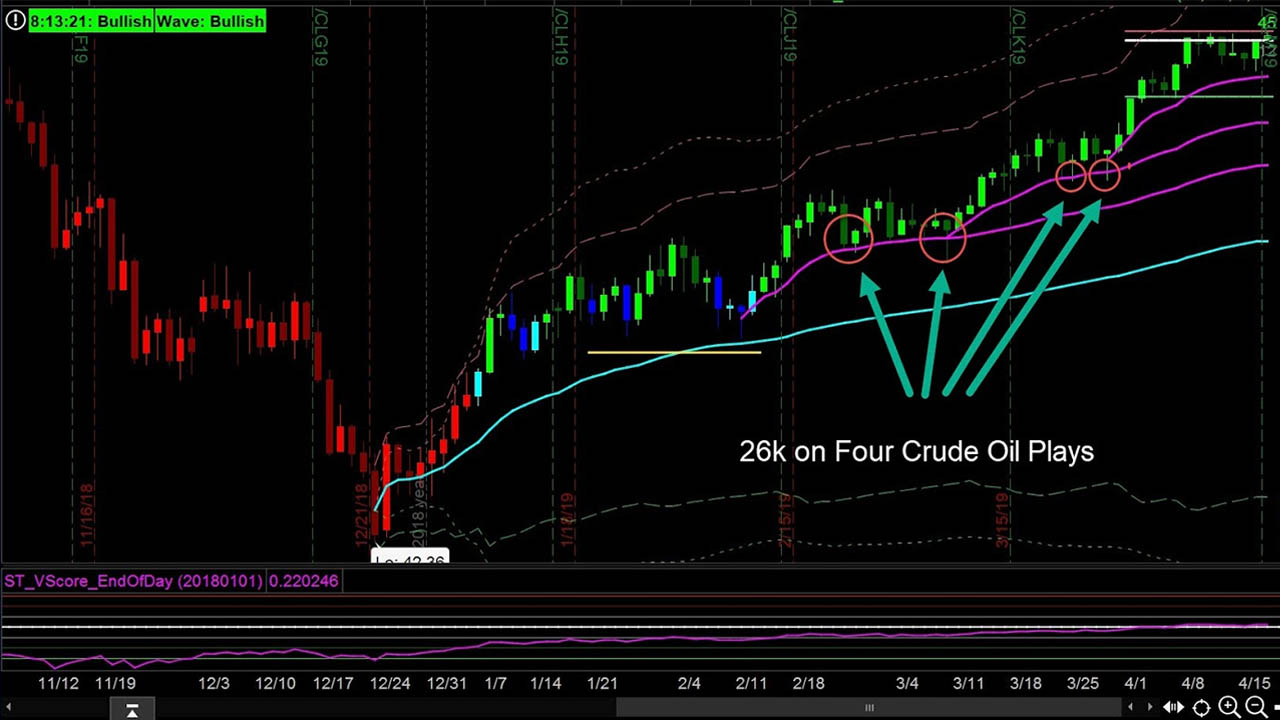

• Creating widely used tools like GRaB Candles, the 34 EMA Wave, VScore, and her VWAP tools.

• Trading and teaching across futures, options, forex, stocks and ETFs – not just one niche.

• A conservative, probability-focused approach: fewer trades, higher quality, with clear structure and exits.

• A strong educational track record: books, media appearances, and thousands of traders mentored through Simpler Trading.

Most importantly for VWAP Max: she has spent years refining volume-weighted price analysis as a way to see where institutions are truly positioned – not where retail traders are guessing.

In short, she’s not just bolting VWAP onto a chart because it’s trendy. VWAP is integrated into her entire trend-following and market-structure playbook.

What the VWAP Max Tool Package is really about

On the surface, this package is “just” an indicator/tool set and training. In reality, what you’re getting is a framework for:

• Seeing institutional value zones in real time

• Knowing when price is “cheap,” “expensive,” or “fair” relative to where the big money is positioned

• Avoiding random entries and exits by anchoring decisions to VWAP and its bands

• Turning messy intraday price action into a clear structure you can plan trades around

While Simpler Trading doesn’t always publish a line-by-line syllabus, students and Raghee’s public content make it clear that VWAP Max revolves around four pillars:

1. Core VWAP concepts applied the “Raghee way”

You’re not just taught what VWAP is; you’re taught how to use it as a decision engine.

Expect to learn:

• How to interpret VWAP as a dynamic “institutional fair value” line.

• How standard deviation bands around VWAP can frame high-probability support/resistance zones.

• When to buy discounts below VWAP and when to fade or short premiums above VWAP – based on trend, not guesswork.

• How to avoid the common VWAP mistakes retail traders make (like treating it as a magical line that works the same in every environment).

Raghee filters VWAP through her trend-following lens. That means she isn’t just showing “VWAP bounces”; she’s combining it with structure, higher time frames, and her other tools.

2. Anchored VWAP and session logic

VWAP is powerful, but its real muscle shows up when it’s *anchored* to specific events.

VWAP Max dives into concepts like:

• Anchoring VWAP to market opens (cash session, London, New York, etc.)

• Anchoring to key events: FOMC releases, earnings, breakouts, or major price pivots

• Stacking multiple anchored VWAPs on the chart to see where institutional flows cluster

• Using VWAP “zones” to plan entries, scale-ins, and scale-outs instead of single-price hero entries

This is where traders start saying things like, “I finally understand why the market turned exactly there.” You’re learning to see the invisible footprints of order flow.

3. Integrating VWAP with Raghee’s trend tools

Raghee is not a one-indicator trader; she’s famous for her:

• 34 EMA Wave – three exponential moving averages that define trend and structure

• GRaB Candles – color-coded candles that instantly show bullish, bearish, or neutral sentiment

• VScore and other volatility and range studies

VWAP Max shows you how to:

• Only take VWAP trades in the direction of the dominant 34 EMA Wave trend.

• Use GRaB Candles to confirm whether VWAP pullbacks align with sentiment.

• Filter out low-quality trades by combining VWAP zones with historical hourly price movement and volatility ranges.

• Set stops and targets that respect the market’s actual volatility instead of arbitrary dollar amounts.

This integration is crucial: you’re not just learning VWAP; you’re learning where it fits into a complete, logical trading plan.

4. Trade examples, workflows, and templates

One of Raghee’s strengths as an educator is walking through real trades:

• Pre-market preparation: where she anchors VWAP, which levels matter, and what she’s watching.

• Intraday execution: how she builds into positions around VWAP, handles partial profits, and moves stops to break even.

• Swing and multi-day trades: when VWAP still matters versus when daily structure and her wave take over.

• Post-trade review: how to tag, review, and improve your VWAP setups over time.

Students often report that seeing her apply the rules repeatedly across different days and instruments is what finally “clicks” VWAP into something usable.

Real student feedback: what traders actually say

Across forums, social media, and reviews of Raghee’s work, a few consistent themes show up around her VWAP and related tools:

1. Clarity and structure

Traders praise her for demystifying complex concepts and turning them into simple, repeatable checklists. Many say things like “I stopped overtrading” or “I finally know what I’m waiting for” after adopting her VWAP and trend filters.

2. Compatibility with busy schedules

Because VWAP Max is built on clearly defined zones and pre-planned levels, several part-time traders mention that it works well even if you can’t stare at screens all day. You can prepare your levels, then wait for price to come to you.

3. Works across multiple markets

Students appreciate that her VWAP approach is not restricted to one asset. They use it on:

• Index futures (ES, NQ, RTY)

• Stocks and ETFs

• Forex pairs

• Even options, using VWAP levels as decision points for directional or credit spreads

4. Realistic, not hyped

You won’t see Raghee promising “turn $100 into $10,000 in a week.” Feedback often highlights her conservative, probability-focused mindset. She stresses trend, participation, and risk control above “home run” trades.

Are there criticisms?

Any serious evaluation has to acknowledge the flip side.

• Some traders on forums label her and Simpler Trading as “system sellers.” That’s a common accusation against any educator with paid tools. The reality: she does sell systems, but she also trades them live and has a long public track record.

• VWAP is not a magic bullet. A few traders complain that they “already knew VWAP” and expected miracles. The truth is, the edge comes from how you use VWAP inside a robust process — not from the line itself. If you’re looking for hands-free automation or a black-box indicator that prints buy/sell arrows, VWAP Max is not that.

• There is a learning curve. Integrating VWAP with her wave, candles, and volatility work takes time. If you’re unwilling to study and practice, you won’t extract the full value.

So who is VWAP Max really for?

This course and tool package is best suited for:

• Futures traders who want to align with institutional flow instead of guessing intraday turns.

• Stock and ETF traders looking for better entries on trends, pullbacks, and breakouts.

• Options traders who struggle with timing and want precise price levels to structure spreads or directional trades.

• Forex traders seeking a cleaner intraday framework that deals with volatility and sessions more intelligently.

• Any trader tired of indicator overload who wants a focused, rules-based approach built on volume, price, and trend.

If you’re completely new to trading, you’ll still benefit – but expect to go a bit slower as you get comfortable with basic charting. If you’re intermediate or advanced and already use VWAP casually, this can be the upgrade that turns it from “nice to have” into your primary execution framework.

Why get it through TSCourses?

Now let’s talk about the context that makes this a particularly attractive opportunity if you’ve been eyeing Raghee’s tools for a while.

TSCourses’ positioning is simple:

Brand: TSCourses – The Best Place to Learn Online Courses

Promise: Commit to the cheapest price in the market

Delivery: Instant Google Drive link after payment

Guarantee: 1

More courses you might like

Linda Raschke – One Week S,P 500 Day Trading Intensive Workshop II

In terms of the world of buying and selling, there isn't any scarcity of strategies,...

If you are serious about mastering Forex trading in the smartest, most structured way possible,...

50 Eyes Market Analysis – Elliott Wave

Unlocking Market Secrets and techniques: Introducing the 50 Eyes Market Analysis – Elliott Wave Course...

Apteros Trading – NADRO – Merritt Black

# Apteros Trading NADRO Methodology: Is Merritt Black's Futures Trading Course Worth Your Investment in...