Jason Paul Rogers – From Zero Idea To 7 Figure Acquisitions

- Last Updated: 02-18-2021

- Duration: 28.21 hour(s), 126 video(s)

- Size: 14.6 GB

$79

Buy More, Save More!

2 Courses

10% OFF

3 Courses

15% OFF

5 Courses

30% OFF

Why Choose TSCourses?

- Learn online or download via Google Drive

- All course files are included

- Free course updates via email

- Seen it cheaper? We'll beat the price

Course Description

If you are serious about buying your first business – even if you feel you “know nothing” right now – Jason Paul Rogers’ course From Zero Idea To 7 Figure Acquisitions is one of the most practical, execution-focused trainings in the space. And through TSCourses, you can access it at the cheapest price on the market, with instant delivery and a 15-day satisfaction guarantee.

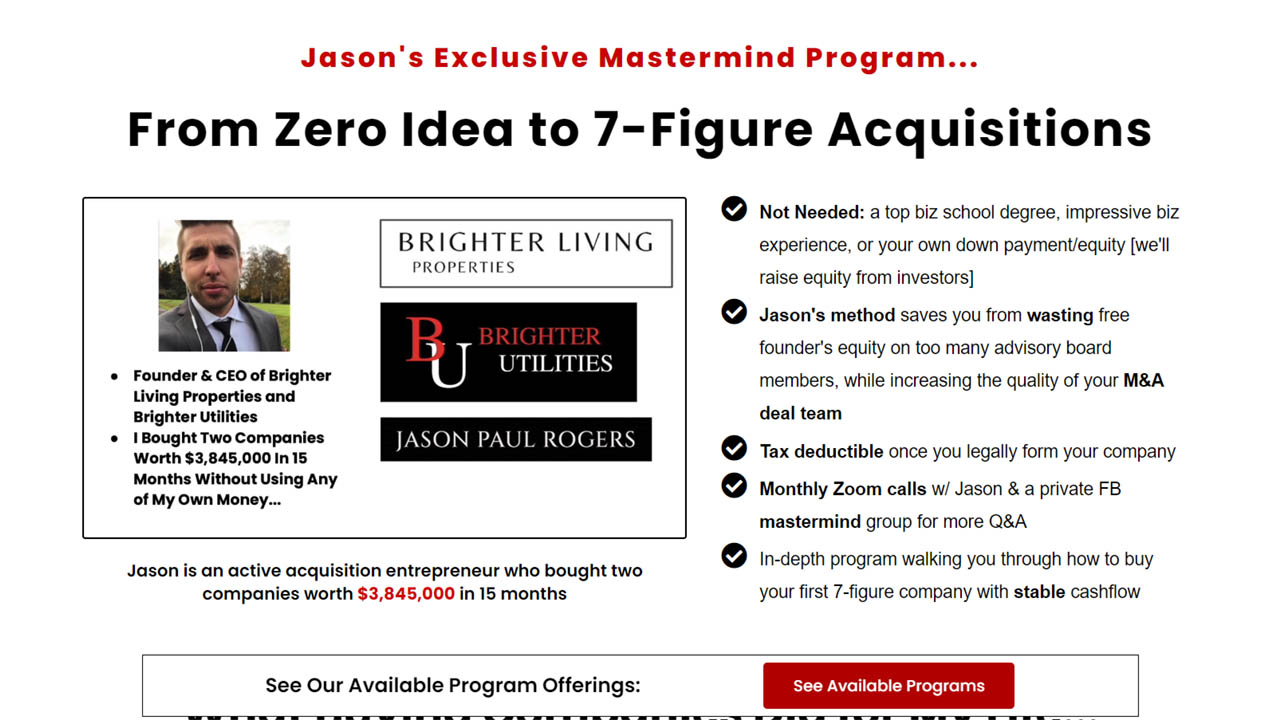

Who is Jason Paul Rogers – and why listen to him?

Jason Paul Rogers is not a theorist teaching M&A out of a textbook. He is an acquisition entrepreneur who went from having no dealmaking background to closing multiple 7‑figure acquisitions in the “boring” small business space, primarily using bank and seller financing rather than huge piles of his own cash.

Over the past years, Jason has built a strong presence around teaching everyday professionals how to buy real, cash-flowing businesses using structured processes. He charges at least $1,000 per hour for one‑on‑one M&A consulting, and the From Zero Idea To 7 Figure Acquisitions program is essentially his entire playbook packaged into a step‑by‑step curriculum.

This matters because if you’re an entrepreneur, marketer, consultant, trader, or ambitious professional, you don’t need more theory. You need a practitioner who has negotiated with sellers, sat across from bankers, wrangled lawyers and accountants, and actually closed deals – then reverse‑engineered that path for you.

Inside the curriculum: a full M&A roadmap for beginners

The core promise of the course is simple: take someone who has “zero idea” about buying a business and give them everything they need to close a 7‑figure acquisition as efficiently and safely as possible.

Here is how the curriculum does that:

The Intro – Creating Wealth Through Buying Businesses

Jason begins by reframing how wealth is created. Instead of spending 10 years trying to start something from scratch, he shows why acquiring an existing, profitable business can be a much faster and more stable path. This intro sets your mindset, goals, and acquisition criteria, so you know exactly what you’re hunting for.

Module 1 – Picking the right industry and crafting your investment thesis

Most people fail before they even start because they chase the wrong industries or random deals. In this module, Jason walks you through:

– How to choose an industry with enough deal flow, margins, and financing appetite.

– How to build a “bulletproof investment thesis” so you aren’t wasting months on unprofitable or risky sectors.

This is where you go from dreaming about “buying a business” to targeting a specific, logical niche.

Module 2 – Building your world‑class M&A team

You cannot buy a business alone. You need an accountant, lawyer, sometimes an industry operator, and lender relationships. Jason shows:

– Who you need on your deal team.

– How to recruit serious professionals without burning a ton of cash or giving away unnecessary equity.

This is especially powerful if you’re worried that “no one will take me seriously.” The course gives scripts and frameworks to present yourself credibly even on your first deal.

Module 3 – Accounting: due diligence protection without exorbitant fees

Here Jason lays out how to work with accountants so you are protected in due diligence, while avoiding the trap of paying massive retainers for work that doesn’t move the deal forward. You learn what matters in the financials versus what is just noise, and how to evaluate true profitability and risk.

Module 4 – Legal: structuring and protecting your deals

This module focuses on lawyers, contracts, and deal structure. Jason explains how to recruit legal protection that is strong but cost‑effective, and he shares templates and deal documents in his Legal Vault that you can use with your in‑house or external counsel. This alone can save you thousands in billable hours.

Module 5 – Generating endless deal flow

Without quality deal flow, nothing happens. Jason shows:

– How to find businesses for sale beyond just public listings.

– How to reach out to owners in a way that gets replies.

– What sources of deals are fluff and which ones actually produce closable opportunities.

For many students, this is the most valuable section because it turns “I can’t find any deals” into a predictable outreach and pipeline process.

Module 6 – Analyzing deals, valuation and due diligence

In this phase you learn how to:

– Value small businesses realistically.

– Read financial statements to spot red flags.

– Run due diligence so you don’t buy a ticking time bomb.

Jason has said in interviews that understanding how to value and de‑risk deals is a core edge, and this module is built to give beginners that edge without needing an MBA or Wall Street background.

Module 7 – Negotiating price and terms like a veteran

Most entrepreneurs overpay or accept bad terms simply because they don’t know what’s negotiable. Here you learn:

– How to structure offers that protect your downside.

– How to negotiate not just price, but seller financing, earn‑outs, and contingencies.

– How to talk to sellers so you are perceived as a serious, trustworthy buyer even if it’s your first deal.

Module 8 & 9 – Financing and SBA 7(a) loans (for US buyers)

Jason goes deep into:

– How to approach banks and get lenders competing to finance your acquisition.

– How to use SBA 7(a) loans to minimize the cash you bring to the table.

– How to combine bank loans, equity investors, and seller financing to do “no or low money down” deals.

If you have been held back by the belief “I don’t have the money,” this part of the course is designed to dismantle that excuse with a clear financing playbook.

Module 11 – Running and growing your acquired business

Closing is just the beginning. This module focuses on:

– Stabilizing the company post‑close.

– Management and operations for non‑operators.

– Strategic levers to grow revenue and improve profitability.

Real acquisitions are judged months and years after closing, and this content helps you turn a good purchase into a great long‑term asset.

Bonuses – The real “over‑the‑shoulder” advantage

On top of the core modules, the course includes:

– Jason’s Legal Vault – deal documents you can hand to your lawyer to adapt, saving huge amounts of time.

– A Vault of recorded calls, webinars, and case studies with other acquisition entrepreneurs. This shows real deals, real mistakes, and real problem‑solving.

– Q&A call replays where Jason critiques students’ deals, which helps you recognize patterns and avoid common errors.

– Access to a members‑only Facebook group, giving you a peer community and direct line to other dealmakers worldwide.

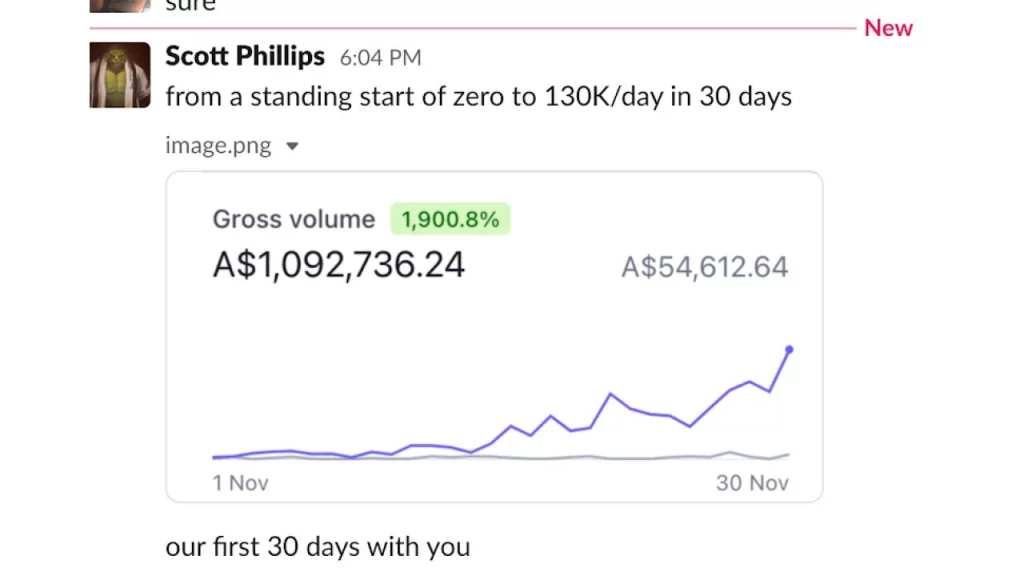

Real student experiences and who this is for

Jason’s brand is built around real student success stories rather than hype. He openly states the program is not for people with low energy or a “get rich quick” mindset. No results are guaranteed, and he emphasizes that buying a business means work, sacrifice, and tackling problems as they arise.

Some students, like a 23‑year‑old who acquired a 7‑figure auto body business without using

More courses you might like

Katie Proctor – The Designers Toolkit

Enterprise into the realm of design evolution with Katie Proctor - The Designers Toolkit. This...

Why Study Trendy Sales Studying learn how to promote is likely one of the most...

Alen Sultanic – Nothing Held Back (NHB ) (Up to 082024)

Are you trying to take your small business to the subsequent degree and set your...

Gene Morris – Pay Per Call Blueprint 2.0

Gene Morris’s Pay Per Call Blueprint 2.0 is a comprehensive online course designed to teach...